Introduction

Understanding cash flow statements is essential for businesses of all sizes. Cash flow statements provide valuable insights into the financial health and performance of a company. We will discuss the importance of cash flow statements in financial analysis.

The Importance of Understanding Cash Flow Statements

Cash flow statements offer a comprehensive view of the cash inflows and outflows within a specific period. By analyzing these statements, businesses can gain a deeper understanding of their liquidity, solvency, and overall financial stability. It allows them to make informed decisions regarding investments, expenses, and financial planning.

Furthermore, understanding cash flow statements helps businesses identify potential cash flow issues before they escalate into major financial problems. It allows them to evaluate their ability to generate and manage cash, ensuring a sustainable operation.

Purpose of Cash Flow Statements in Financial Analysis

Cash flow statements play a vital role in financial analysis as they serve various important purposes. Here are some key ways in which they contribute to a comprehensive understanding of a company’s financial performance:

- Assessing Operating Activities: Cash flow statements provide insights into the cash generated or used in day-to-day operations. This helps in evaluating the company’s ability to generate consistent cash flow from its core business activities.

- Evaluating Investing Activities: Cash flow statements detail the cash inflows and outflows related to investments, such as property, plant, and equipment. This allows investors and analysts to assess the company’s investment decisions and their impact on cash flow.

- Understanding Financing Activities: Cash flow statements highlight the cash inflows and outflows related to financing activities, including debt repayments, equity issuances, and dividend payments. This helps in evaluating the company’s financial structure and its ability to raise capital.

- Predicting Future Cash Flow: Analyzing past cash flow statements enables businesses to forecast future cash flow trends and plan accordingly. It provides essential information for budgeting, investment decision-making, and overall financial management.

:max_bytes(150000):strip_icc()/cashflowstatement-recirc-blue-777721714b8f49a5b5103337a8510653.jpg)

Components of a Cash Flow Statement

Operating Activities: Cash Flows from Day-to-Day Business Operations

The operating activities section of a cash flow statement shows how much cash is generated or used in a company’s daily operations. Cash flows include money received from selling goods or services, and money paid for operating expenses like salaries, rent, and utilities. This section helps evaluate the company’s ability to generate consistent cash flow from its core business activities. Positive cash flow from operations means that the company is making enough money from its business activities to pay for its expenses and invest in growth.

Investing Activities: Cash Flows from Investments in Assets

The investing activities section of a cash flow statement details the cash inflows and outflows related to investments in assets. This includes cash flow from buying or selling property, plant, and equipment, as well as investing in other businesses. Positive cash flows from investing activities indicate that the company is making strategic investments in its future growth. Negative cash flows from investing activities can mean that the company is selling assets or reducing its investments.

Financing Activities: Cash Flows from Raising Capital and Paying Back Debt

The financing activities section of a cash flow statement highlights the cash inflows and outflows related to financing activities. This includes cash received from issuing equity or borrowing funds, as well as cash paid for dividends and debt repayments. Positive cash flows from financing activities mean that the company is handling its capital structure well and can get funds from external sources. Negative cash flows from financing activities may indicate that the company is repaying debt or returning capital to shareholders.

Analyzing Cash Flow Statements

When it comes to assessing a company’s financial health and performance, the cash flow statement is a fundamental tool. Understanding cash flow statements helps investors and analysts assess a company’s ability to generate and manage cash effectively, as well as its liquidity and solvency.

Understanding Positive and Negative Cash Flows

Positive cash flows from operating activities indicate that a company is generating sufficient cash from its core business operations. This is a positive sign as it means the company can cover its expenses and potentially reinvest in growth opportunities. Negative cash flows from operating activities could mean that the company is having difficulty generating sufficient cash, which could be worrisome.

If a company has positive cash flows from investing activities, it means that the company is making smart investments in assets that will help it grow in the future. Negative cash flows could indicate divestment or reduced investment activities, requiring further investigation into the company’s strategy.

Positive cash flows in financing activities show that the company is handling its capital structure well and can get money from external sources. Negative cash flows, however, could imply debt repayment or the return of capital to shareholders.

Evaluating the Liquidity and Solvency of a Business

Analyzing the cash flow statement allows for an assessment of a company’s liquidity and solvency. Liquidity refers to the company’s ability to meet short-term obligations, while solvency pertains to its ability to meet long-term obligations.

Positive cash flows are important for evaluating liquidity because they show that the company can pay for its daily expenses. It is also essential to assess the company’s ability to sustain positive operating cash flows over time.

Cash flows from financing activities play a role in determining solvency. Positive cash flows indicate that the company has access to capital to meet its long-term obligations. Negative cash flows can indicate that the company is having difficulties with debt payments or returning money to shareholders, which could impact its long-term ability to survive.

Identifying Potential Cash Flow Problems

Analyzing the cash flow statement enables the identification of potential cash flow problems. Negative cash flows from operations may indicate a business that is declining or unstable, while negative cash flows from investments may suggest poor investment choices or divestment actions.

Furthermore, negative financing cash flows may indicate difficulties in accessing external funding sources or an excessive burden of debt. These potential issues warrant further investigation to assess the overall financial stability and future prospects of the business.

In conclusion, understanding and analyzing cash flow statements are essential for evaluating a company’s financial health and performance. Understanding positive and negative cash flows, evaluating liquidity and solvency, and spotting potential cash flow issues helps investors and analysts make informed decisions and understand the financial stability of the business.

Importance of Cash Flow Management

Cash flow management is essential for the financial health and success of any business. Monitoring and controlling the flow of cash in and out of a business is important to ensure there is enough money to cover expenses, make investments, and take advantage of growth opportunities.

Strategies for Effective Cash Flow Management

To effectively manage cash flow, businesses can employ the following strategies:

- Budgeting and Forecasting: Creating a detailed budget and regularly updating cash flow forecasts allows businesses to anticipate and plan for potential cash flow fluctuations. This enables better financial decision-making and helps prevent cash shortages or excesses.

- Tightening Credit Terms: Businesses can improve their cash flow by implementing stricter credit terms with customers, such as shortening payment terms or offering incentives for early payments. This can help reduce the time it takes to collect receivables and improve cash inflows.

- Controlling Expenses: Carefully managing expenses by implementing cost-saving measures can help maintain a positive cash flow. This may involve renegotiating supplier contracts, reducing discretionary spending, and eliminating unnecessary expenses.

- Monitoring Inventory: Businesses should optimize their inventory levels to avoid tying up excessive cash in unsold products. Implementing inventory management systems and regularly analyzing sales data can help identify slow-moving items or excess stock that can be liquidated to generate cash.

The Impact of Positive Cash Flow on Business Growth

Positive cash flow is crucial for business growth and sustainability. It gives money to invest in new projects, grow operations, start marketing campaigns, hire more workers, and improve infrastructure. Having positive cash flow also enhances the company’s creditworthiness, making it easier to secure financing from lenders if needed.

Common Cash Flow Issues and How to Address Them

Businesses often face cash flow challenges that need to be addressed to maintain financial stability. Some common issues include:

- Late Payment by Customers: Implementing stricter payment terms, offering discounts for early payments, or using invoice factoring services can help accelerate cash inflows and minimize the impact of late payments.

- Seasonal Fluctuations: Businesses that experience seasonal fluctuations can create a cash reserve during peak periods to cover expenses during slower months. This can be achieved by carefully managing revenues and expenses throughout the year.

- Insufficient Working Capital: If a business lacks working capital to cover day-to-day expenses, it may need to seek additional financing options such as business loans, lines of credit, or equity investments.

- Overextension of Credit: Granting excessive credit to customers can strain cash flow. Implementing tighter credit control measures, conducting credit checks, and establishing clear credit terms can help mitigate this issue.

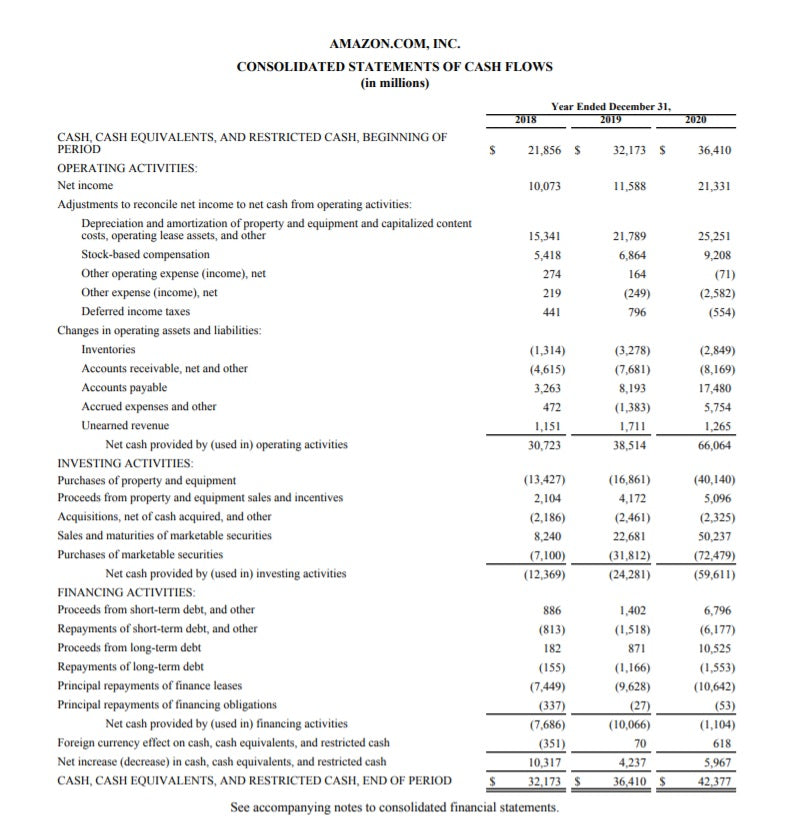

Case Study: Interpreting a Cash Flow Statement

Analyzing a Real-Life Cash Flow Statement Example

To grasp the significance of cash flow statements, let’s examine an example from a hypothetical company called XYZ Inc. The cash flow statement offers information about the company’s cash received and spent over a specific period.

XYZ Inc. Cash Flow Statement (Year Ended December 31, 20XX):

Operating Activities:

Net Income: $100,000

Depreciation: $20,000Increase in Accounts Receivable: $50,000Decrease in Inventory: $10,000Net Cash Provided by Operating Activities: $160,000

Investing Activities:Purchase of Property, Plant, and Equipment: $(50,000)Investment in Marketable Securities: $(30,000)Net Cash Used in Investing Activities: $(80,000)

Financing Activities:Issuance of Common Stock: $25,000Payment of Dividends: $(10,000)Net Cash Provided by Financing Activities: $15,000

Net Increase in Cash: $95,000

Identifying Key Insights and Trends

By analyzing the cash flow statement, several insights and trends can be observed:

- Operating Cash Flow: XYZ Inc. generated a net cash inflow of $160,000 from its operating activities. This indicates that the company’s core operations are generating positive cash flow.

- Investing Cash Flow: The company invested $(80,000) in purchasing property, plant, and equipment, and marketable securities. This suggests that XYZ Inc. is allocating funds towards expanding its capabilities and potentially increasing future profitability.

- Financing Cash Flow: The issuance of common stock resulted in a cash inflow of $25,000, while dividend payments represented a cash outflow of $(10,000). This indicates that the company is utilizing various sources of financing to support its operations.

Drawing Conclusions about the Financial Health of the Company

Based on the cash flow statement, it can be inferred that XYZ Inc. has a healthy financial position. The company’s cash increased by $95,000, showing that they have more money at the end of the period than at the beginning. XYZ Inc. has enough money to pay for its expenses, invest in growth, and meet its financial obligations.

The positive cash flow shows that the company’s main operations are generating enough cash to support its activities. Investing activities show a dedication to long-term growth, while financing activities demonstrate the ability to obtain capital for the company’s operations and expansion.

XYZ Inc. has good financial health. It has positive cash flow, strong investment strategies, and effective financing management.

:max_bytes(150000):strip_icc()/dotdash_Final_Corporate_Cash_Flow_Understanding_the_Essentials_Oct_2020-01-3c5fb3c82fb240c0bad19e14f04ce874.jpg)

Conclusion

Understanding cash flow statements is essential for making informed financial decisions. By analyzing the cash inflows and outflows of a company, you can assess its financial health, liquidity, and ability to meet its obligations. Cash flow statements give important information about a company’s operating, investing, and financing activities. They help stakeholders make informed decisions about investments, loans, and financial strategies.

Summary of key takeaways from understanding cash flow statements

- Cash flow statements provide insights into a company’s cash inflows and outflows during a specific period.

- The operating activities section shows the cash generated or used in relation to the core operations of the business.

- The investing activities section highlights cash flows related to the purchase or sale of assets.

- The financing activities section focuses on cash flow related to debt issuance or repayment, equity issuance, or dividend payment.

- Positive net cash flow means that a company’s cash coming in is more than its cash going out. Negative net cash flow means the opposite.

- Examining the cash flow statement allows us to assess a company’s liquidity, financial well-being, and its capability to fund its operations and expansion strategies.

The role of cash flow statements in financial decision-making

Cash flow statements play a crucial role in financial decision-making. Financial statements provide key information for stakeholders to evaluate a company’s cash generation, operational efficiency, and financial obligations. Investors evaluate cash flow statements to assess a company’s profitability and sustainability, while lenders use them to determine creditworthiness and repayment ability. Executives and managers rely on cash flow statements to monitor and manage cash resources, identify areas for improvement, and make strategic decisions to optimize financial performance.

Resources for further learning

To deepen your understanding of cash flow statements, consider exploring the following resources:

- Accounting textbooks and courses: Look for resources that cover financial statement analysis and specifically focus on cash flow statements.

- Online tutorials and videos: Many websites and platforms offer free or paid tutorials that explain cash flow statements in detail.

- Financial management seminars and webinars: Attend events or webinars that discuss financial statement analysis and cash flow statements.

- Consultation with financial professionals: Reach out to accounting or finance professionals who can provide personalized guidance and insights into cash flow statements. They can answer your questions and provide real-life examples relevant to your specific industry or business.

Learning about cash flow statements can improve your financial knowledge and help you make better decisions about investments, business operations, and financial strategies.