Overview of Keynesian Economics

Introduction to Keynesian Economics

Keynesian Economics, named after the British economist John Maynard Keynes, revolutionized the way we understand economic fluctuations and government intervention. This theory emphasizes the role of aggregate demand—total demand for goods and services—in driving economic growth. Unlike previous theories that leaned heavily on supply-side economics, Keynesian thought realistically acknowledges that economies can experience prolonged recessions when demand falls short.

History and Development of Keynesian Economics

The roots of Keynesian Economics lie in the aftermath of the Great Depression in the 1930s. Traditional economic theories failed to address the depth of the economic crisis, which prompted a re-evaluation of existing models.

- Key Milestones:

- 1936: Keynes published The General Theory of Employment, Interest, and Money, laying the foundation of his ideas.

- Post-WWII: The theory became mainstream as countries adopted policies that aligned with Keynesian principles, focusing on full employment and steady growth.

This paradigm shift ultimately changed government approaches toward economic policy, emphasizing the necessity of intervention in times of economic downturns to stabilize and stimulate the economy.

Theoretical Framework of Keynesian Economics

Aggregate Demand and Aggregate Supply

At the heart of Keynesian Economics is the concept of aggregate demand (AD), which refers to the total demand for goods and services within an economy at a given overall price level and in a given time frame. What makes this concept unique is its focus on the factors that can lead to fluctuations in economic activity.

- Key components of aggregate demand include:

- Consumer Spending: The largest portion of AD, driven by household income and confidence.

- Investment Spending: Business expenditures on capital formation, influenced by interest rates.

- Government Spending: Public sector investments that can stimulate economic growth.

- Net Exports: The balance between exports and imports, which impacts overall demand.

Role of Government Intervention in the Economy

Government intervention is a pivotal aspect of Keynesian Economics, where the state plays a proactive role in managing economic cycles.

- Intervention strategies include:

- Fiscal Policy: Using government spending and tax policies to influence economic activity.

- Monetary Policy: Adjusting interest rates and money supply to regulate economic health.

A personal experience emphasizes this: witnessing a local government implement infrastructure projects during a recession not only improved public services but also created jobs, stimulating local demand. Such interventions highlight how government action can lead to a recovery, aligning closely with Keynesian principles.

Principles of Keynesian Economics

Consumption Function

One of the fundamental principles of Keynesian Economics is the Consumption Function, which illustrates the relationship between income levels and consumer spending. In simple terms, as disposable income increases, so does consumption, but not at a one-to-one rate. This principle highlights that people tend to save a portion of their income, reflecting their propensity to consume or save.

- Key Aspects of the Consumption Function:

- Marginal Propensity to Consume (MPC): The fraction of an additional amount of income that is spent on consumption.

- Average Propensity to Consume (APC): The total consumption divided by total income.

Multiplier Effect

Next is the Multiplier Effect, an exciting concept that explains how initial spending leads to increased consumption and further rounds of spending. For instance, when a government invests in infrastructure, it not only creates immediate jobs but also boosts the income of those workers, who will, in turn, spend on local businesses.

- Understanding the Multiplier:

- A small initial injection of spending can lead to a larger cumulative effect on the economy.

- This underlines the power of fiscal intervention; as spending circulates, it encourages broader economic growth.

Liquidity Preference Theory

Finally, we have the Liquidity Preference Theory, offering insight into why individuals prefer holding cash or liquid assets. According to Keynes, this preference can influence interest rates and investment behavior.

- Factors Influencing Liquidity Preference:

- Transaction Motive: The need to hold money for everyday transactions.

- Precautionary Motive: The desire to keep cash on hand for emergencies.

- Speculative Motive: Holding cash to take advantage of future investment opportunities.

Ultimately, these principles work together to create a framework that explains consumer behavior and economic dynamics, emphasizing the interconnectedness of spending and investment in fostering economic stability and growth.

Criticisms and Limitations of Keynesian Economics

Inflation Concerns

Despite its revolutionary ideas, Keynesian Economics faces significant criticism, particularly regarding inflation concerns. Critics argue that extensive government intervention can lead to excessive inflation, diminishing the purchasing power of money. When demand is stimulated too aggressively, prices tend to rise, creating a scenario referred to as “demand-pull” inflation.

- Key Points on Inflation:

- Cost-Push Inflation: Increases in production costs can also exacerbate inflation, unrelated to demand levels.

- Long-Term Effects: Sustained inflation might lead to uncertainty, causing consumers and businesses to restrain spending.

Crowding Out Effect

Another significant critique of Keynesian policies is the crowding out effect. This occurs when increased government spending leads to a reduction in private sector investment. If the government borrows heavily, it can drive up interest rates, making it more expensive for businesses to invest.

- Consequences of Crowding Out:

- Higher interest rates may deter private spending.

- Long-term growth could be stunted if the private sector is persistently sidelined.

Rational Expectations Critique

Lastly, the Rational Expectations Critique challenges the assumption that individuals and businesses do not anticipate government interventions. Some economists argue that if people expect government policies, they may adjust their behavior, nullifying the intended impacts of these policies.

- Implications of Rational Expectations:

- Individuals may save more in anticipation of higher taxes.

- Businesses might delay investments due to expectations of future government spending.

These criticisms highlight the complexity of economic systems and underscore the need for a balanced approach to economic policy, blending Keynesian principles with other economic theories to address contemporary challenges.

Application of Keynesian Economics in Policy Making

Fiscal Policy

Keynesian Economics plays a crucial role in shaping fiscal policy, which involves government spending and taxation strategies aimed at influencing economic activity. By increasing or decreasing spending and adjusting tax rates, governments can manage aggregate demand effectively.

- Examples of Fiscal Policies:

- Stimulus Packages: In times of economic downturn, such as the COVID-19 pandemic, governments may introduce substantial stimulus measures to boost demand and create jobs.

- Infrastructure Investment: Projects like building roads and schools not only create immediate employment but stimulate wider economic activity.

A standout example is the American Recovery and Reinvestment Act of 2009, designed to combat the recession by investing heavily in public infrastructure and offering tax cuts.

Monetary Policy

Complementing fiscal policy is monetary policy, primarily managed by a nation’s central bank. This approach involves regulating the money supply and interest rates to influence economic growth.

- Key Measures in Monetary Policy:

- Lowering Interest Rates: To encourage borrowing and spending, central banks may reduce interest rates, making loans more affordable.

- Quantitative Easing: This unconventional method involves purchasing financial assets to increase the money supply and lower long-term interest rates.

For instance, in response to the 2008 financial crisis, the Federal Reserve significantly cut interest rates and engaged in quantitative easing to stimulate the economy. By leveraging both fiscal and monetary policy through Keynesian principles, governments can more effectively navigate economic challenges and work towards recovery.

Keynesian Economics in Practice: Case Studies

The Great Depression

One of the most significant case studies illustrating Keynesian Economics is the Great Depression of the 1930s. The severe economic downturn saw massive unemployment and plummeting consumer demand, challenging existing economic theories. During this time, John Maynard Keynes advocated for increased government spending to boost demand, marking a turning point in economic thought.

- Key Measures Taken:

- New Deal Programs: U.S. President Franklin D. Roosevelt implemented a series of initiatives aimed at economic recovery, focusing on job creation through public works projects.

- Social Safety Nets: These programs included unemployment insurance and social security, providing direct support to those in need and stimulating overall demand.

Post-2008 Financial Crisis

Fast forward to the Post-2008 Financial Crisis, where Keynesian strategies were again put into practice. The collapse of major financial institutions led to a severe recession, prompting governments worldwide to intervene with fiscal stimulus measures.

- Key Responses:

- U.S. Stimulus Packages: The American Recovery and Reinvestment Act of 2009 aimed to save and create jobs through significant public investment.

- Global Coordination: Central banks around the world engaged in coordinated monetary policy, lowering interest rates and implementing quantitative easing.

Having witnessed these events firsthand, one can appreciate how governments can draw from Keynesian principles to stabilize economies in crises, ultimately fostering recovery and growth. This dual application of Keynesian Economics has proven effective in navigating challenging economic landscapes.

Modern Perspectives on Keynesian Economics

New Keynesian Economics

In recent decades, developments in economic theory have given rise to New Keynesian Economics, a movement that seeks to address some of the limitations of traditional Keynesian models. By incorporating microeconomic foundations, it aims to explain price stickiness and how it affects employment and output.

- Key Features of New Keynesian Economics:

- Rational Expectations: Unlike classical Keynesians, New Keynesians incorporate the concept that individuals and firms make economic decisions based on their rational expectations about the future.

- Nominal Rigidities: The theory emphasizes that prices and wages adjust slowly, preventing the economy from achieving equilibrium.

This approach has been particularly valuable in understanding how short-term demand shocks can lead to prolonged recessions.

Neo-Keynesian Economics

Following closely is Neo-Keynesian Economics, which further blends Keynesian thought with contemporary economic theories. This framework emphasizes the importance of both demand and supply-side factors while also embracing elements from other schools of thought, such as monetarism.

- Key Components of Neo-Keynesian Economics:

- Policy Mix: A combination of fiscal and monetary policies is advocated to stimulate economic growth.

- Employment Focus: It stresses the role of full employment as essential for economic stability and social welfare.

Reflecting on these modern perspectives, it’s clear how Keynesian Economics continues to evolve, adapting to new economic realities while remaining relevant in today’s complex global landscape. This evolution underscores the ongoing significance of Keynesian principles in addressing contemporary economic challenges.

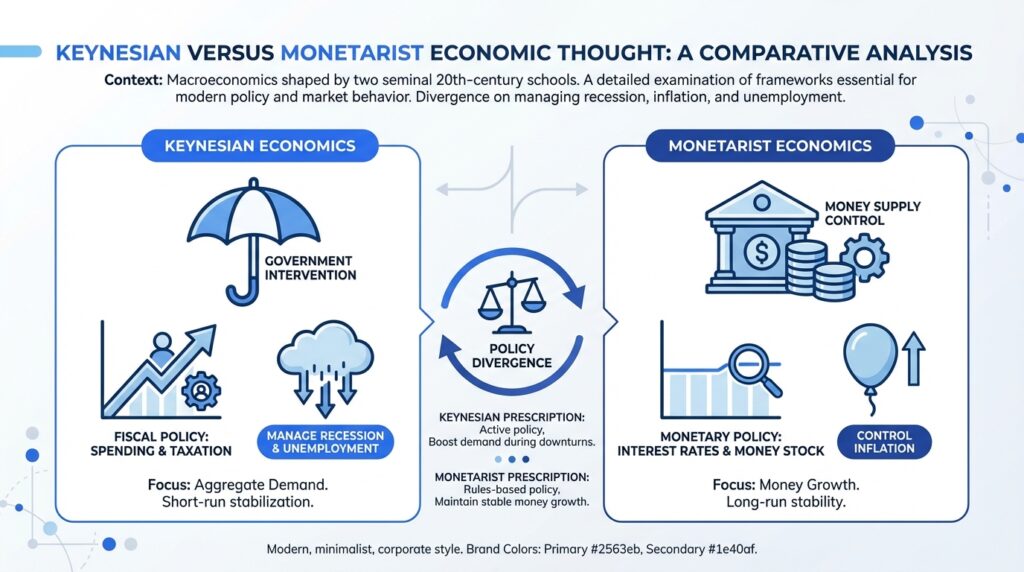

Comparison with Other Economic Schools of Thought

Classical Economics

When examining Classical Economics, it’s essential to understand that this school emphasizes the self-regulating nature of markets. Classical economists, such as Adam Smith and David Ricardo, argue that economies naturally tend toward full employment through the free interplay of supply and demand. They believe that government intervention is often unnecessary, or even detrimental.

- Key Principles of Classical Economics:

- Say’s Law: Supply creates its own demand; thus, overproduction is merely a temporary imbalance.

- Long-term Perspectives: Focus on long-term growth and efficiency rather than short-term fluctuations.

While there are merits to this perspective, many find it lacking in addressing severe economic downturns, as experienced during the Great Depression, which Keynesian theorists sought to rectify.

Monetarism

In contrast, Monetarism, spearheaded by Milton Friedman, emphasizes the control of money supply as the primary driver of economic stability and inflation. Monetarists critique Keynesian approaches, arguing that excessive government intervention can lead to inflation and distort market signals.

- Key Features of Monetarism:

- long-run focus on monetary policy: Advocates for stable policies that aim for a predictable increase in the money supply.

- Inflation Targets: Monetarists believe that controlling inflation is paramount for ensuring a healthy economy.

From personal experience, navigating economic discussions often reveals how these schools, while differing in their beliefs, offer valuable insights when interpreting today’s dynamic economic landscape. Understanding these perspectives enriches the dialogue around effective policy-making and the ongoing evolution of economic thought.

Future of Keynesian Economics

Adaptation to Changing Economic Landscapes

As we look toward the future of Keynesian Economics, its adaptability becomes a compelling strength. In an era marked by rapid technological advancements and globalization, Keynesian principles are evolving to meet new challenges. This flexibility is critical as economies face issues such as income inequality, climate change, and the impacts of automation.

- Key Adaptations:

- Emphasis on Inclusive Growth: Modern Keynesians advocate for policies that not only boost demand but also ensure equitable distribution, addressing wider societal concerns.

- Focus on Sustainability: Policymakers are increasingly considering environmental factors in fiscal and monetary strategies, showcasing a comprehensive approach to economic health.

Relevance in Contemporary Economies

The relevance of Keynesian Economics in today’s environment remains profound, especially considering recent global crises such as the COVID-19 pandemic. During these challenging times, the principles of boosting aggregate demand through government spending have proven essential in stabilizing economies.

- Continued Importance:

- Direct Support Initiatives: The rapid implementation of stimulus packages worldwide reflects Keynesian ideals, reinforcing demand and supporting vulnerable populations.

- Guiding Monetary Policy: Central banks continue to draw on Keynesian ideas when responding to economic downturns, signaling their enduring influence.

Reflecting on these contemporary adaptations, it’s clear that Keynesian Economics remains a vital framework for navigating the complexities of today’s global economy. As it evolves, it will undoubtedly continue shaping policies that aim for recovery and sustainable growth.

For More Information

Check out my AI-generated podcast here: