Introduction to Profit Loss Statements

A Profit Loss statement, also called an income statement or earnings statement, is a financial report that gives managers a clear picture of a company's profitability. This statement summarizes revenues, expenses, and net income or loss over a specific period. For managers, understanding and analyzing the Profit Loss statement is crucial for making informed business decisions.

Importance of Profit Loss Statements for Managers

Profit Loss statements play a vital role in helping managers assess their company's financial performance. Here are some key reasons why Profit Loss statements are important:

- Financial Performance Evaluation: Managers can evaluate the profitability of their business by comparing revenues and expenses. This allows them to identify areas of strength and weakness, helping them make informed decisions to improve profitability.

- Budgeting and Forecasting: Profit Loss statements are essential tools for managers when creating budgets and forecasts. Managers can estimate future revenues and expenses by analysing historical financial data, aiding in effective budget planning.

- Decision Making: Profit Loss statements provide managers with valuable insights into the financial impact of their decisions. Managers can make informed choices about pricing, cost management, and investment opportunities by understanding the impact on revenues and expenses.

Components of a Profit Loss Statement

Profit Loss statements typically include the following components:

- Revenue: This represents the total income generated from sales or services provided.

- Cost of Goods Sold (COGS): This includes the direct costs of producing goods or services, such as raw materials, labor, and manufacturing overhead.

- Gross Profit: This is calculated by subtracting the COGS from the revenue and represents the profit made before deducting other expenses.

- Operating Expenses: These are the costs incurred in running the day-to-day operations of the business, such as rent, salaries, utilities, and marketing expenses.

- Operating Income (or Loss): This is calculated by subtracting the total operating expenses from the gross profit and represents the profit made from core operations.

- Net Income (or Loss): This is the final result after deducting non-operating expenses and taxes from the operating income.

Understanding these components enables managers to identify areas that require improvement or cost-reduction measures, thereby improving overall profitability.

Understanding Income

Revenue and sales

Revenue refers to the total amount of money generated from the sales of products or services. It is an important figure that provides insight into the financial health of a business. By analyzing revenue, managers can evaluate their sales strategies' effectiveness and identify improvement areas.

Sales, on the other hand, represents the specific transactions where products or services are exchanged for money. It is vital for managers to track sales because it directly contributes to revenue. By monitoring sales trends and patterns, managers can make informed pricing, marketing, and inventory management decisions.

Cost of goods sold and gross profit

The cost of goods sold (COGS) encompasses all expenses directly associated with producing or purchasing the products being sold. This includes the cost of raw materials, labor, and overhead. Subtracting the COGS from the revenue yields the gross profit.

Gross profit is an essential metric that measures the profitability of a business. It indicates how efficiently a company is utilizing its resources to generate revenue. Monitoring the gross profit margin allows managers to evaluate their cost control measures and find ways to improve the business's overall profitability over time.

In summary, understanding income involves analyzing revenue and sales as well as monitoring the cost of goods sold and the resulting gross profit. By carefully examining these key factors, managers can make informed decisions, optimize their operations, and drive the financial success of their business.

Analyzing Expenses

Operating expenses and overhead costs

Operating expenses are the day-to-day business costs, such as rent, utilities, salaries, and advertising. These expenses are necessary for the business to operate and are directly related to producing goods or services. Analyzing operating expenses helps managers understand where funds are being spent and find ways to save costs or improve efficiency.

Overhead costs are indirect expenses that are not directly tied to production but are necessary for the overall functioning of the business.Examples of overhead costs include office supplies, insurance, and administrative salaries. Monitoring overhead costs is important to ensure the business stays within budget and identify areas where expenses might be higher than expected.

Non-operating expenses and net profit/loss

Non-operating expenses are costs not directly related to the business's core operations. These expenses can include interest payments on loans, depreciation of assets, or losses from the sale of investments. Analyzing non-operating expenses helps managers understand these costs' impact on the business's overall financial health and assess the effectiveness of financial strategies.

Net profit or loss is the amount of money left after subtracting all expenses (operating and non-operating) from the business revenue. This figure represents the bottom line and provides managers with a clear indication of the business's financial performance to manage the financial aspects of a business effectively. Analyzing the net profit or loss allows for informed decision-making and the implementation of strategies to improve profitability.

In conclusion, understanding and analyzing expenses is crucial for managers to effectively manage the financial aspects of a business. By closely monitoring and evaluating operating expenses, overhead costs, non-operating expenses, and net profit or loss, managers can make informed decisions to optimize their organisations' financial health and success.

Interpreting Profit Loss Statements

Trends and patterns in income and expenses

When managing a business, understanding the financial health is crucial. One of the primary tools for evaluating financial performance is the profit-loss statement, also known as the income statement. This statement provides a snapshot of a company's revenues, expenses, and net profit or loss over a specific period.

One key aspect of interpreting a profit loss statement is analyzing the trends and patterns in income and expenses. By examining the revenue streams and expenditure categories, managers can identify growth areas and potential cost-saving opportunities. They can identify the most profitable products or services and concentrate on growing those areas. Likewise, they can pinpoint any areas of excessive expenses and develop strategies to reduce costs.

Key ratios and financial indicators

Profit loss statements can be used to calculate financial ratios and indicators, which provide insights into a company's financial health. These ratios include gross profit margin, net profit margin, return on assets, and return on equity. By evaluating these ratios, managers can assess the profitability, efficiency, and overall business performance.

Understanding and interpreting profit loss statements allows managers to make informed decisions, set goals, and monitor the financial progress of their organization. It provides a comprehensive view of the company's financial performance, enabling them to identify strengths and weaknesses and take necessary actions to improve the bottom line.

In summary, profit loss statements are essential tools for managers to evaluate and monitor the financial performance of their business. By analyzing trends, patterns, and key financial ratios, managers can gain valuable insights that help drive growth, maximize profitability, and ensure their organisation's long-term success.

:max_bytes(150000):strip_icc()/IncomeStatementFinalJPEG-5c8ff20446e0fb000146adb1.jpg)

Using Profit Loss Statements for Decision Making

Profit Loss Statements, also called income statements or P&L statements, are important financial tools that give managers essential information.By analyzing these statements, managers can make informed decisions to improve profitability and financial performance. Here are two key ways in which Profit Loss Statements are used for decision making.

Identifying areas for cost-cutting or revenue improvement

Profit Loss Statements provide a comprehensive overview of a company's revenue and expenses. Managers can identify areas where costs are high or revenue is underperforming. By analyzing cost trends and benchmarking against industry standards, managers can make strategic decisions to reduce expenses and improve operational efficiency. They can also identify opportunities to increase revenue, such as focusing on high-profit products or targeting new customer segments. Profit Loss Statements enable managers to allocate resources effectively and make data-driven decisions to optimize financial performance.

Setting financial goals and budgeting

Profit and Loss Statements are crucial in enabling managers to establish clear financial objectives and create effective budgets. By understanding the company's past financial performance, managers can identify areas of improvement and set realistic targets for the future. Profit Loss Statements provide insights into revenue trends, profit margins, and operating expenses, which are crucial for accurate budgeting. Managers allocate resources according to the company's financial goals, ensuring spending aligns with projected revenue and expenses. Managers can review Profit Loss Statements to track progress and make adjustments for long-term sustainability.

In conclusion, Profit Loss Statements are powerful tools for managers to analyze financial performance and make informed decisions. By identifying areas for cost-cutting or revenue improvement and setting financial goals through budgeting, managers can optimize profitability and ensure their organisation's long-term success.

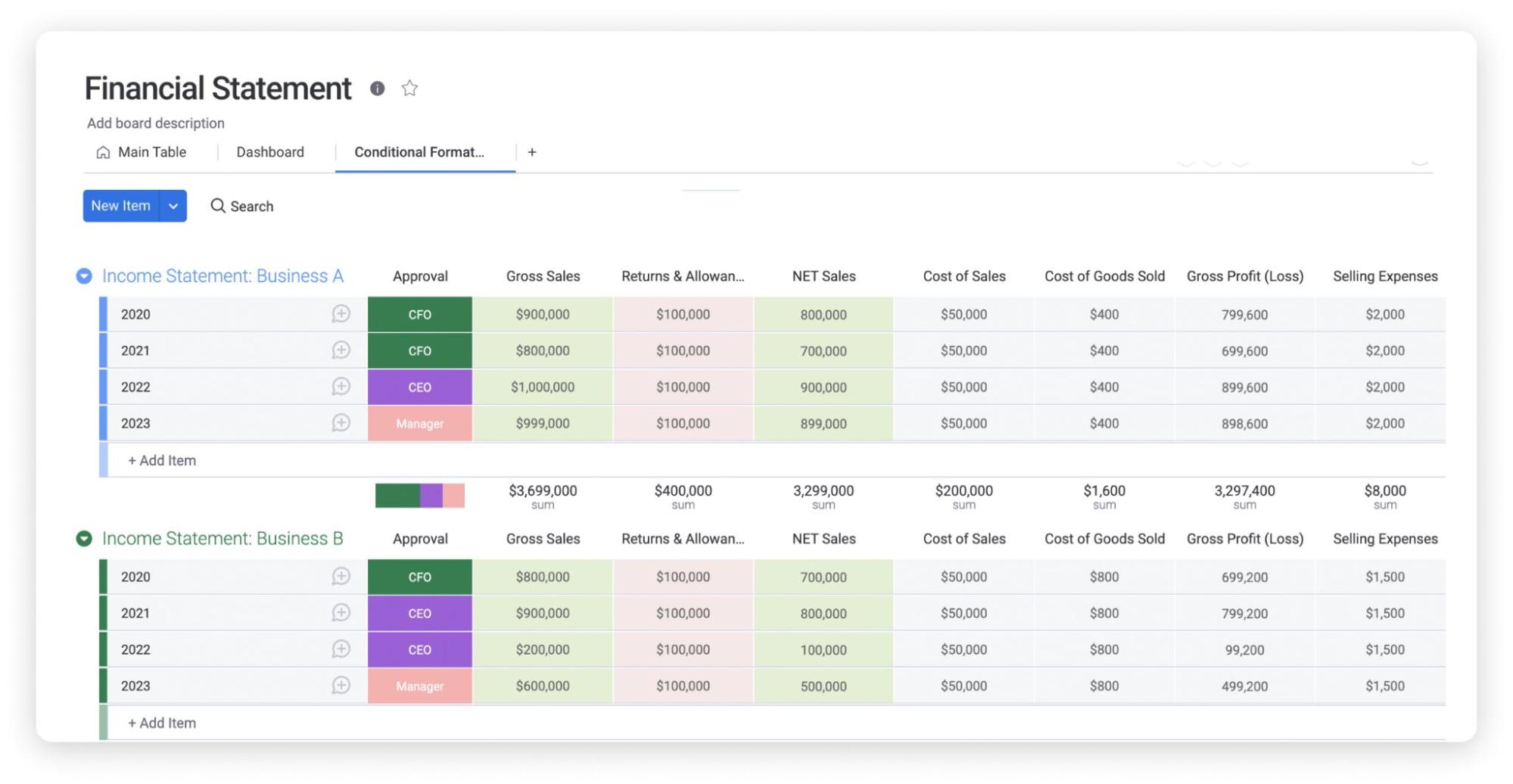

Case Study: Analyzing a Profit Loss Statement

Reviewing a sample profit loss statement

When it comes to managing a business, understanding your financial statements is crucial, and one of the most important statements is the profit loss statement. A statement that shows a company's earnings, expenses, and costs during a specific time, usually a year.

To illustrate the process of analyzing a profit-loss statement, let's consider a hypothetical case study. ABC Company, a retail business, has provided their profit loss statement for the year ending December 31, 2022.

The profit loss statement consists of several sections: revenues, cost of goods sold, operating expenses, and net income. Reviewing each section helps managers understand the business's financial health and find areas of concern or potential improvement.

Identifying areas of concern and potential improvement

One important aspect of analyzing a profit loss statement is to compare the current year's figures with previous years or industry benchmarks. This helps identify areas of concern or areas where your business may excel.

In the case study, ABC Company's revenues have grown by 10% compared to last year, showing positive growth.However, their operating expenses have also increased by 15%, which may raise concerns about efficiency or cost control.

By analyzing the profit loss statement, managers can identify areas where costs can be reduced or revenues increased to improve profitability. This may involve strategies such as renegotiating supplier contracts, optimizing inventory management, or implementing cost-saving initiatives.

In conclusion, understanding and analyzing a profit loss statement is crucial for managers to make informed decisions and improve the financial performance of their business. Regularly reviewing these statements allows for proactive measures to address areas of concern and maximize potential for improvement.

Importance of Regular Monitoring and Reporting

Reviewing profit loss statements regularly

Managers need to regularly monitor and review profit loss statements to make informed decisions and guide the business in the right direction. Profit loss statements, also known as income statements, provide a detailed breakdown of a company's revenues, expenses, and net profit over a specific period.

By regularly reviewing these statements, managers can assess the business's financial health, identify any areas of concern, and make necessary adjustments to maximize profitability. It allows them to analyze revenue trends, track expenses, and determine which products or services are generating the most profit. This information enables managers to make data-driven decisions regarding pricing strategies, cost control measures, and investment opportunities.

Communicating financial performance to stakeholders

Managers are also responsible for communicating the business's financial performance to stakeholders, such as investors, shareholders, and board members. Profit loss statements serve as a valuable tool in presenting this information accurately and transparently.

Managers can establish trust and credibility with stakeholders by effectively communicating financial performance. It allows them to showcase the company's achievements, highlight areas of improvement, and outline future growth prospects. Regular reporting also enables stakeholders to assess the company's financial stability and make informed investment decisions.

Regular monitoring and reporting of profit loss statements are essential for managers to make informed decisions and communicate the business's financial performance to stakeholders. By staying on top of financial data and trends, managers can drive profitability and ensure the company's long-term success.

Conclusion

Profit loss statements are important for managers to make decisions and monitor the financial health of their businesses. These statements show a company's revenue, expenses, and profitability over a specific period. By analyzing these statements, managers can identify trends, track performance, and make strategic adjustments to improve the bottom line.

Summary and key takeaways from the guide

This guide has provided an overview of profit loss statements and their importance for managers. Key takeaways from the guide include:

- Profit loss or income statements show a company's financial performance over a specific period.

- The statement includes revenue, expenses, and net income or loss.

- Components of a profit loss statement include sales revenue, cost of goods sold, operating expenses, and taxes.

- Managers can use profit loss statements to evaluate profitability, monitor expenses, and identify areas for improvement.

- Comparative analysis of multiple periods can help identify trends and make informed decisions.

Tips for effective use of profit loss statements.

To effectively utilize profit loss statements, managers should consider the following tips:

- Regularly review and analyze profit loss statements to stay informed about the business's financial performance.

- Use comparative analysis to identify patterns, trends, and potential areas of concern.

- Seek professional help or consult a financial advisor if interpreting profit loss statements is challenging.

- Use the insights gained from profit loss statements to make data-driven decisions and improve profitability.

- Consider implementing financial software or tools to simplify generating and analyzing profit loss statements.

Managers can use profit loss statements to understand their company's financial position and make strategic decisions for growth and profitability.