Introduction to the Balance Sheet

Understanding the purpose and importance of the balance sheet

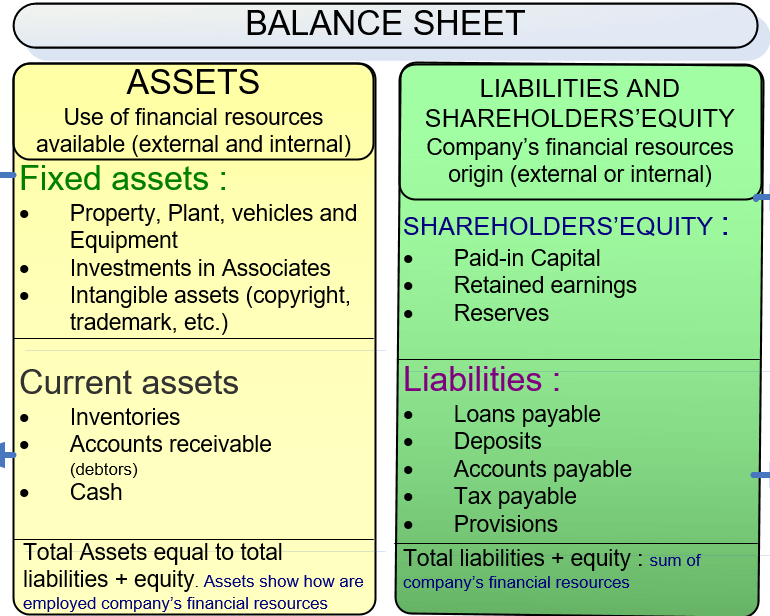

The balance sheet shows a company’s financial position at a specific time. Managers need to use this tool to evaluate the financial status of their business. The balance sheet shows the company’s assets, liabilities, and equity. It helps managers make decisions and assess the company’s performance.

The importance of the balance sheet lies in its ability to provide insights into the financial position of a business. Managers can use it to know the company’s assets, liabilities, and equity. By analyzing these components, managers can assess the company’s ability to meet its financial obligations, make strategic decisions, and identify areas for improvement.

Key components of the balance sheet: assets, liabilities, and equity

The balance sheet comprises three main components: assets, liabilities, and equity.

Assets represent what the company owns or controls and include cash, accounts receivable, inventory, equipment, and property. These assets help generate revenue and contribute to the company’s value.

Liabilities, on the other hand, are the company’s financial obligations or debts. They include loans, accounts payable, and accrued expenses.

Equity represents the ownership interest in the company. It is the residual interest after deducting liabilities from assets. Equity can be contributed by owners through investments or accumulated through retained earnings.

By analyzing the balance sheet, managers can assess the composition and structure of the company’s assets and liabilities. This information enables them to evaluate liquidity, financial stability, and the overall financial health of the business. It also helps in making informed decisions regarding investments, financing options, and expansion strategies.

Managers need to understand the purpose and components of the balance sheet to effectively manage the financial aspects of their business and achieve long-term success.

Analyzing Assets on the Balance Sheet

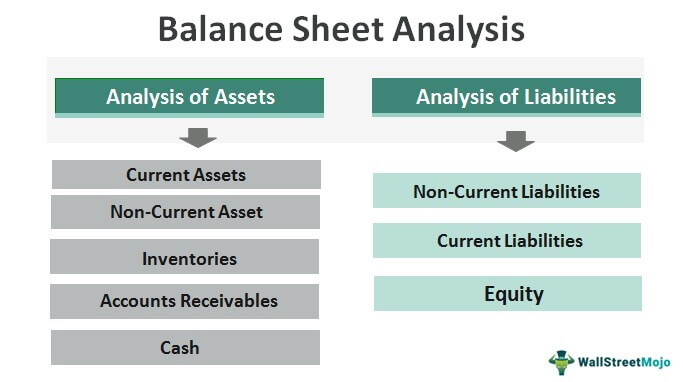

When it comes to analyzing a company’s financial health and stability, one of the key components to focus on is its assets. Assets are an essential part of the balance sheet, providing valuable insights into a company’s current and long-term financial standing.

Current Assets and Their Significance

Current assets can be converted into cash or used up within a year or an operating cycle. They represent the resources that a company can readily access to cover its short-term obligations. Examples of current assets include cash, accounts receivable, inventory, and prepaid expenses.

Analyzing current assets is crucial for managers as it helps them determine the company’s liquidity and its ability to meet short-term financial obligations. Having enough current assets is crucial for a company. It ensures that the company can pay off its debts and cover expenses in the future. On the other hand, a low level of current assets may indicate financial instability and potential difficulties in meeting obligations.

Non-Current Assets and Their Impact on Financial Health

Non-current assets, also known as long-term assets, are assets that are not expected to be converted into cash or used up within a year. These assets typically have a useful life of more than one year and contribute to the company’s long-term value. Examples of non-current assets include property, plant, and equipment, investments, and intangible assets.

Analyzing non-current assets provides insights into a company’s long-term financial health and growth potential. These assets reflect the company’s investment in infrastructure, technology, and intellectual property, which can contribute to future revenues and competitiveness. Additionally, non-current assets can affect a company’s borrowing capacity, as they can serve as collateral for loans.

Managers must analyze assets (both current and non-current) to evaluate their company’s financial health and stability. Understanding the importance of these assets helps managers make educated decisions about resource allocation, investments, and financial planning. This will ultimately lead to long-term success for the business.

Examining Liabilities on the Balance Sheet

When it comes to analyzing a company’s financial health and stability, one crucial aspect to focus on is its liabilities. Liabilities represent a company’s financial obligations and debt that it owes to external parties. Let’s talk about how both current and long-term liabilities affect a company’s balance sheet and how managers can manage them effectively.

Current Liabilities and Managing Short-Term Obligations

Current liabilities are obligations that need to be settled within a year or an operating cycle. They typically include accounts payable, accrued expenses, short-term loans, and current portions of long-term debt. Analyzing current liabilities is essential for managers as it helps them assess the company’s ability to meet short-term obligations and maintain liquidity.

By carefully managing current liabilities, managers can ensure that the company has enough working capital to cover its day-to-day operations. This involves closely monitoring payment terms with suppliers, implementing effective cash flow management strategies, and negotiating favorable financing terms.

Long-Term Liabilities and Their Implications for Future Growth

Long-term liabilities, on the other hand, are obligations that extend beyond the next operating cycle or one year. They typically include long-term loans, bonds payable, and lease obligations. Analyzing long-term liabilities provides insights into a company’s ability to meet its long-term financial commitments and fund future growth initiatives.

Managers need to carefully evaluate the impact of long-term liabilities on the company’s overall financial structure. Liabilities can help fund expansion or investment in assets, but they also require repayment and incur interest expenses. It is crucial to balance leveraging long-term debt for growth opportunities and maintaining a sustainable debt-to-equity ratio.

Effective management and monitoring of current and long-term liabilities can help managers make better decisions about resource allocation, investment strategies, and financial planning. Ensuring the company’s long-term financial health and stability is crucial for its success in a competitive business environment.

Understanding Equity on the Balance Sheet

When analyzing a company’s financial health and stability, managers need to understand the concept of equity on the balance sheet. Equity is the ownership stake in a company. It represents the remaining value after subtracting liabilities from assets. There are different types of equity, and managers can measure shareholder value through equity analysis.

Types of Equity: Owner’s Equity and Retained Earnings

There are two main types of equity found on the balance sheet: owner’s equity and retained earnings.

Owner’s equity represents the initial investment made by the owner or shareholders into the company. It includes capital contributions, such as cash or assets, that are used to start or expand the business. Owner’s equity also captures any subsequent investments or withdrawals the owner makes.

Retained earnings, on the other hand, represent the portion of the company’s profits that are reinvested into the business. They are accumulated over time and reflect the company’s retained profits after dividends or distributions to shareholders. Retained earnings are an important measure of the company’s financial performance and its ability to generate profits.

Measuring Shareholder Value through Equity Analysis

Equity analysis is a valuable tool for managers to assess the value created for shareholders. It involves analyzing the components of equity, such as owner’s equity and retained earnings, to evaluate the company’s financial health and performance.

By examining changes in owner’s equity over time, managers can assess the profitability, liquidity, and solvency of the business. Positive changes in owner’s equity indicate that the company is generating profits and increasing its net worth.

Similarly, analyzing retained earnings helps managers understand the company’s ability to generate sustainable long-term profits. Increasing retained earnings indicate that the company is reinvesting its profits back into the business for growth opportunities.

Equity analysis can also provide insights into the company’s funding structure and its reliance on debt versus equity financing. To ensure long-term financial stability and reduce excessive risk, managers should maintain a healthy balance between debt and equity.

Understanding equity on the balance sheet is important for managers to assess financial health and value for shareholders.By analyzing owner’s equity and retained earnings, managers can make informed decisions about resource allocation, capital investment, and financial planning, ultimately driving the long-term success of the company.

Interpreting the Balance Sheet

When it comes to assessing a company’s financial health and stability, the balance sheet is a crucial tool that managers must understand. It shows the company’s financial status at a specific time, including its assets, debts, and ownership.

Using financial ratios to evaluate performance

Financial ratios are key tools for evaluating a company’s performance and financial health. By analyzing the relationship between different elements on the balance sheet, managers can gain insights into aspects such as liquidity, solvency, and profitability.

For example, the current ratio compares a company’s current assets to its current liabilities and helps assess its liquidity. A ratio above 1 indicates that the company has enough assets to cover its short-term obligations.

Similarly, the debt-to-equity ratio compares a company’s total debt to its equity and indicates its level of financial leverage. A higher ratio suggests a greater reliance on debt financing, which can pose risks in the long run.

Assessing liquidity, solvency, and profitability

The balance sheet provides essential information for assessing a company’s liquidity, solvency, and profitability.

Liquidity refers to a company’s ability to meet its short-term obligations. By analyzing the composition of current assets and current liabilities on the balance sheet, managers can gauge whether the company has enough cash and liquid assets to cover its immediate needs.

Solvency, on the other hand, focuses on a company’s long-term financial viability. The balance sheet shows the company’s long-term assets, long-term liabilities, and equity. It helps managers evaluate if the company can meet its long-term obligations.

Profitability analysis examines a company’s capacity to create profits for its shareholders by analyzing the relationship between its assets, liabilities, and equity. Comparing net income to total assets or equity on the balance sheet can provide insights into the company’s profitability.

The balance sheet is important for managers to evaluate a company’s financial health and make decisions. Managers analyze financial ratios to assess a company’s liquidity, solvency, and profitability, which helps them make informed decisions.

Effective Balance Sheet Management

When it comes to managing a company’s financial health and stability, the balance sheet is a vital tool for managers. It shows the company’s financial status at a given time, including its assets, liabilities, and equity.In this article, we will explore effective strategies for optimizing assets, liabilities, and equity, as well as how managers can leverage the balance sheet for decision-making.

Strategies for Optimizing Assets, Liabilities, and Equity

- Asset Management: Managers can optimize assets by carefully managing inventory levels, reducing accounts receivable, and efficiently utilizing fixed assets. By improving asset turnover ratios, managers can enhance profitability and free up cash for other investments.

- Liability Management: It is crucial to manage liabilities to maintain financial stability carefully. This includes monitoring debt levels, renegotiating favorable loan terms, and managing interest rate risk. By effectively managing liabilities, managers can minimize financial risks and ensure sufficient cash flow for operational needs.

- Equity Management: Managers can optimize equity by evaluating the company’s capital structure. To find the best mix of debt and equity financing, consider factors such as capital costs, risk tolerance, and growth prospects. By optimizing equity, managers can reduce financial leverage risks and maximize profitability.

Leveraging the Balance Sheet for Decision-Making

The balance sheet provides valuable information for managerial decision-making. By analyzing various financial ratios derived from the balance sheet, managers can assess the company’s financial performance, liquidity, solvency, and profitability. For example:

- Liquidity: Ratios like the current ratio and quick ratio help managers evaluate the company’s ability to meet short-term obligations and manage liquidity risk.

- Solvency: The debt-to-equity ratio and interest coverage ratio provide insights into the company’s long-term financial stability and its capacity to service its debts.

- Profitability: Ratios such as return on assets and return on equity measure the company’s ability to generate profits and returns for its shareholders.

Understanding ratios and information on the balance sheet helps managers make better decisions about investments, financing, and operational strategies.

In conclusion, effective balance sheet management is essential for maintaining a company’s financial health. By employing strategies to optimize assets, liabilities, and equity, and leveraging the balance sheet for decision-making, managers can effectively navigate the complexities of financial management and drive the success of their organization.

Pitfalls and Challenges of Balance Sheet Analysis

Common mistakes to avoid when interpreting the balance sheet

Analyzing a balance sheet is crucial for managers to gain insights into a company’s financial health and make informed decisions. However, there are common pitfalls that need to be avoided when interpreting the balance sheet.

One common mistake is solely relying on the numbers without considering the context. It is essential to understand the industry benchmarks, economic conditions, and the company’s specific circumstances to accurately assess its financial position.

Another mistake is not understanding the limitations of certain financial ratios. Each ratio provides only a partial picture, and relying solely on one ratio may lead to a distorted analysis. It is crucial to consider multiple ratios and use them in conjunction with other financial statements for a comprehensive assessment.

Additionally, managers should be cautious of window dressing or manipulation techniques that can disguise the true financial condition. This could include practices such as inflating asset values or understating liabilities. It is essential to thoroughly analyze the balance sheet and look for any inconsistencies or red flags.

Overcoming challenges in accurate financial assessment

Accurately assessing a company’s financial position presents several challenges for managers. Here are some strategies to overcome these challenges:

- Obtain accurate and up-to-date information: Ensure that the balance sheet reflects the latest financial transactions and entries. Regularly review and reconcile the accounts to identify any discrepancies.

- Understand the business and industry: Familiarize yourself with the specific dynamics of the industry in which the company operates. This understanding will help you identify relevant key performance indicators and potential risks.

- Engage in ongoing financial education: Stay updated with accounting principles and financial analysis techniques. This knowledge will enable you to interpret the balance sheet accurately and make informed decisions.

- Consult financial experts: If you encounter complex financial scenarios or require a deeper understanding of certain aspects, don’t hesitate to seek guidance from financial professionals, such as accountants or financial advisors.

To better analyze balance sheets and make informed decisions, managers should avoid common mistakes and use effective strategies to get valuable information.

In conclusion, interpreting the balance sheet is an integral part of financial management. To ensure a company’s success, managers should focus on accurate financial assessment and avoid mistakes and challenges. This will allow them to make better decisions and understand the company’s financial health.

Conclusion

Managing a company’s balance sheet is a critical task for managers, as it provides valuable insights into the financial health of the organization. Understanding balance sheet analysis challenges and using strategies helps managers make informed business decisions.

It is crucial to avoid common mistakes when interpreting the balance sheet. Managers should not solely rely on the numbers but also consider the context, including industry benchmarks and economic conditions. Financial ratios have limitations. To conduct an accurate analysis, it is important to use multiple ratios in conjunction with other financial statements. Managers should be careful about window dressing and manipulation techniques that hide the real financial situation of the company.

Managers should regularly review and reconcile accounts to have accurate and up-to-date financial information. Familiarizing themselves with the business and industry dynamics will help identify relevant key performance indicators and potential risks. Seek advice from professionals like accountants or financial advisors to improve your understanding of complex financial situations.

To sum up, managing the balance sheet helps managers understand their company’s financial health and make informed decisions for success.

Key takeaways and the importance of balance sheet management for managers

The balance sheet is a crucial financial statement that provides insights into a company’s assets, liabilities, and equity. By managing the balance sheet effectively, managers can:

- Assess financial health: The balance sheet allows managers to evaluate the company’s liquidity, solvency, and overall financial stability. It provides a snapshot of the organization’s financial position at a given point in time.

- Managers can make better decisions about budgeting, investment, financing, and resource allocation with accurate and up-to-date balance sheet information.It helps them understand the company’s available resources and financial constraints.

- Identify financial risks and opportunities: By analyzing the balance sheet, managers can identify potential financial risks, such as high levels of debt or inadequate liquidity. They can also uncover opportunities for growth, such as surplus cash that can be invested in new projects or acquisitions.

- Communicate with stakeholders: The balance sheet is a critical tool for communicating with stakeholders, including investors, lenders, and shareholders. It provides transparency and helps build trust by showcasing the company’s financial health and stability.

Additional resources for further learning

For further learning on balance sheet management and financial analysis, here are some recommended resources:

- Investopedia: A comprehensive online resource that provides articles, tutorials, and videos on various financial topics, including balance sheet analysis.

- The book “Financial Accounting: Tools for Business Decision-Making” by Paul D. Kimmel explains financial accounting principles, such as balance sheet analysis and management.

- Coursera and Udemy offer many financial analysis courses online. These courses provide in-depth knowledge and practical skills in analyzing financial statements.

Remember, effective balance sheet management is crucial for managers to make informed decisions and ensure the financial stability and success of their organizations. Managers should continuously learn and keep up with financial best practices. This will help them acquire the skills needed to analyze balance sheets effectively.